“Indian FinTech sector is set to generate $190B

annual revenues by

2030”

FT MBA Ranking 2025

#1 in India in Pedagogical

FT MBA Ranking 2025

#1 in India in Pedagogical Triple Accreditation First B-School in India to get accreditation by EQUIS, AMBA and AACSB

Triple Accreditation First B-School in India to get accreditation by EQUIS, AMBA and AACSB Member of CEMS Only Indian

B-School to be part of this global alliance of leading business schools, multinational companies and

NGOs

Member of CEMS Only Indian

B-School to be part of this global alliance of leading business schools, multinational companies and

NGOs Ranked #1 BT-MDRA Best B-School 2023, Fortune India Best B-School Survey 2023, Open Magazine's Best B-School

Survey 2024

Ranked #1 BT-MDRA Best B-School 2023, Fortune India Best B-School Survey 2023, Open Magazine's Best B-School

Survey 2024 Ranked #5 India Ranking by

NIRF 2024

Ranked #5 India Ranking by

NIRF 2024 Ranked #65 QS Global MBA

Rankings

Ranked #65 QS Global MBA

Rankings

The Indian Institute of Management Calcutta was established as the first national institute for Post Graduate Studies and Research in Management by the Government of India in November 1961, in collaboration with Alfred P. Sloan School of Management (MIT), the Government of West Bengal, The Ford Foundation, and the Indian Industry. Over the years, IIM Calcutta has grown into a mature institution with a global reputation, imparting high-quality management education. It has been playing a pioneering role in professionalizing Indian management through its Post Graduate and Doctoral level Programmes, Executive Training Programmes, and Research and Consulting Activities. For more information, please visit www.iimcal.ac.in.

The FinTech industry in India is growing at a break-neck speed and technology innovation is powering this growth. The industry now needs highly skilled professionals who can manage and navigate the FinTech business world which is filled with phenomenal opportunities.

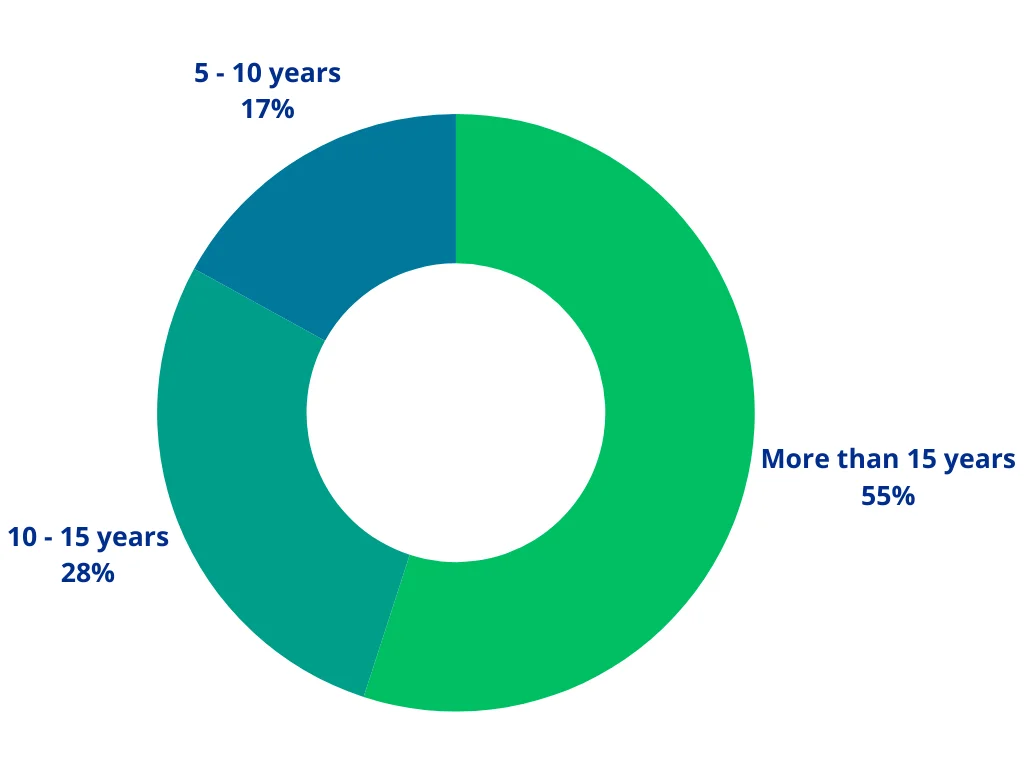

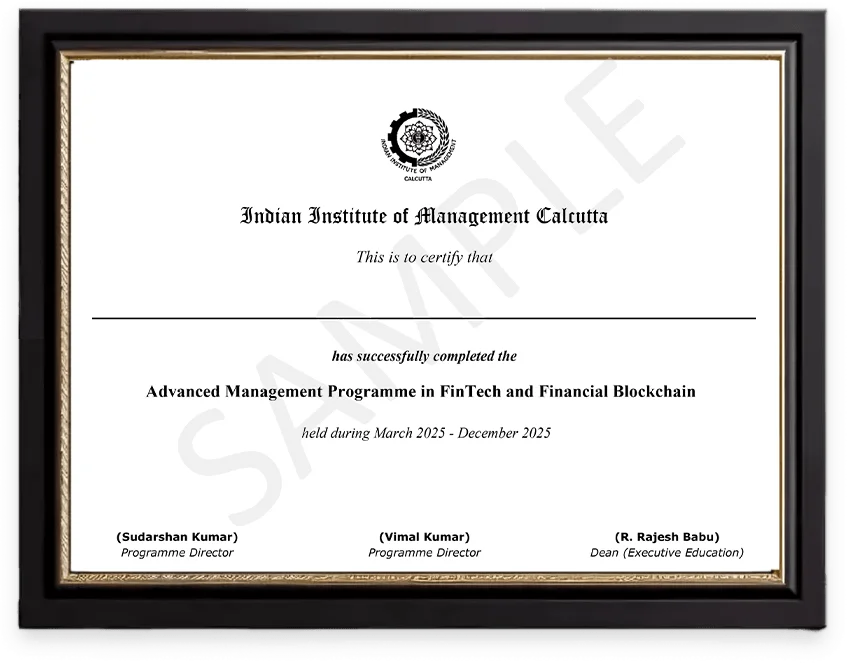

IIM Calcutta, in association with TalentSprint, offers a 9-Month Advanced Management Course in FinTech and Financial Blockchain (AMPFFB). The course is for senior working professionals in Banking, Consulting, Financial Services, Insurance, Management, and Technology, who want to be at the forefront of the FinTech Revolution and wish to lead FinTech initiatives in their organization or want to start their own. The programme is currently running its 10th Cohort with 1050+ participants and 275+ companies across all cohorts. IIM Calcutta, with its expertise in quantitative courses, analytics programmes, and financial markets is well placed to equip professionals with both the academic framework and the practical skill sets to help set a firm footing in this brave new financial world order.

The course is delivered through interactive live online sessions, ensuring flexibility for working professionals while maintaining the rigour of an IIM Calcutta certification providing a unique opportunity for professionals to enhance their expertise and stay ahead in the ever-evolving FinTech industry.

Get Programme Insights from

Relationship Manager Request a Callback

Sudarshan Kumar Assistant Professor, IIM Calcutta

Sudarshan Kumar Assistant Professor, IIM Calcutta Professor Sudarshan is a specialist in fixed income, macro-finance, financial networks, and quantitative finance. Kumar earned his B.Tech from IIT Kharagpur and his Ph.D from IIM Ahmedabad.

Vimal Kumar M Assistant Professor, IIM Calcutta

Vimal Kumar M Assistant Professor, IIM Calcutta Prof. Vimal Kumar M holds a PhD in Information Systems and Analytics and a Bachelor of Engineering in Computer Science & Engineering.

Provide foundation of finance covering financial statement analysis, valuation and financing. PE/VC perspective on investing in the early age startups.

Understand the origin and history of FinTech and the building blocks. Important verticals of Fintech space. Financial issues in LendingTech, WealthTech, InsurTech and Challenger Banks.

Understand the evolution of digital payment and learn emerging paradigms of B2C, C2C, and B2B payment systems and their advantages. Learn about digital wallets, UPI, digital currency, NFC/QR code-based payment, etc.

Understand blockchain/DLT concepts and know about designs of dApps, smart contracts. Learn about various blockchain implementations, business use cases, bitcoin, altcoin, stablecoin, CBDC.

Understand various aspects of FinTech product development and management, business plan and entrepreneurial finance. Learn about innovation and creative disruptions in the FinTech space.

Illustrious alumni network of 1050+ FinTech Leaders | Executive Education Alumni of IIM Calcutta

All logos belongs to respective companies

Application Fee

₹2,500

| Installments | Amount* | Dates |

|---|---|---|

| Registration fee | ₹20000 | As per selection email |

| 1st Installment | ₹1,40,000 | As per selection email |

| 2nd Installment | ₹1,56,000 | May 2025 |

| 3rd Installment | ₹1,56,000 | August 2025 |

| Total Programme Fee | ₹4,72,000 |

![]() Special Pricing for

Corporates**

Special Pricing for

Corporates**

**Applicable only for enterprises nominating their employees as a group

2 campus visits of 3 days at IIM Calcutta.

Fees paid are non-refundable and non-transferable.

Modes of payment available

Internet Banking

Internet Banking Credit/Debit Card

Credit/Debit Card UPI Payments

UPI PaymentsInterest-Based Schemes

EMI as low as ₹19,996/Month

Loan Partners

The IIM Calcutta Fintech course equips professionals with both the academic and research insights coupled with practical knowledge and enables them for the brave new financial world order. Participants will get in-depth exposure to core FinTech domains.

Participants will learn from the leading Faculty of IIM Calcutta and work on interesting Capstone Case Studies. As a participant, you will also be able to network and associate with current and future FinTech leaders.

On the successful completion of this IIM Calcutta Fintech course, participants will receive

IIM Calcutta Fintech course is a first of its kind by an IIM. With FinTech evolving as the new E-commerce and the industry’s exploding demand for expertise, this programme has been launched by IIM Calcutta in association with TalentSprint.

IIM Calcutta is ranked #3 in Asia by FT. With IIM Calcutta’s expertise in Finance, Business, Technology, Markets and Analytics, it is well placed to launch this programme for middle and senior management professionals.

TalentSprint with its deep understanding of the FinTech industry, access to industry experts, and a state of art technology platform has been chosen by IIM Calcutta as the right partner for this programme.

This programme is best suited for management professionals at mid and senior levels from Banking, Financial Services, FinTech, Regulators, Industry bodies, Start-ups and Technology organizations. Participants aspiring to be future FinTech leaders and keen to create a FinTech blueprint for their organizations from across the country and abroad will be your peers in this programme.

Covid 19 has altered the business landscape extensively. However, this crisis could benefit the FinTech industry by accelerating digitization and making digital-only the new norm. Services such as lending, insurance, wealth management etc. are expected to go digital, driven to provide consumers with a user-friendly experience. In the next few years, rather than being one of the channels, FinTech will become a primary channel for financial services.

With global FinTech adoption reaching 64%, FinTech is clearly becoming mainstream. India tops FinTech adoption at 87%, with China.

The financial institutions in India are viewing FinTech as an enabler, giving rise to a number of strategic partnerships with FinTech firms. And the industry is creating new roles, positions, and opportunities for people with the unique expertise needed to fill them.

This is the time to pursue the FinTech Programme and fuel your career with a new beginning. Become an early adopter of this cutting-edge technology and brave the new financial world order.